The AI App Builder Race: Market Share Reality Behind Lovable's Traffic Surge

In the rapidly evolving AI app development landscape of 2025, Swedish startup Lovable has captured headlines with its impressive growth trajectory. However, a closer examination reveals a more nuanced picture of the market. While Lovable's meteoric rise is generating significant buzz, established platforms like Bubble, Replit, and Cursor continue to maintain their dominance in actual market share. This analysis explores the current state of the AI development platform market and examines the gap between traffic metrics and market leadership.

Lovable's Explosive Growth Story

Lovable has achieved remarkable momentum in early 2025, securing substantial funding and rapidly expanding its user base. The platform's journey began with a $7.5 million pre-seed round in January 2025, quickly followed by a $15 million Series A round in February 2025, led by Creandum with participation from notable angel investors including Charlie Songhurst, Adam D'Angelo, and Thomas Wolf of Hugging Face[1].

What stands out most is Lovable's revenue acceleration:

The key to this rapid adoption appears to be Lovable's strategic pivot from being primarily developer-focused to offering a graphical interface accessible to non-developers. This shift has significantly expanded their target audience beyond developers to include founders, product designers, and marketers[2]. By positioning itself as a "full-stack AI software builder that anyone can use," Lovable has tapped into the growing demand for accessible AI-powered development tools.

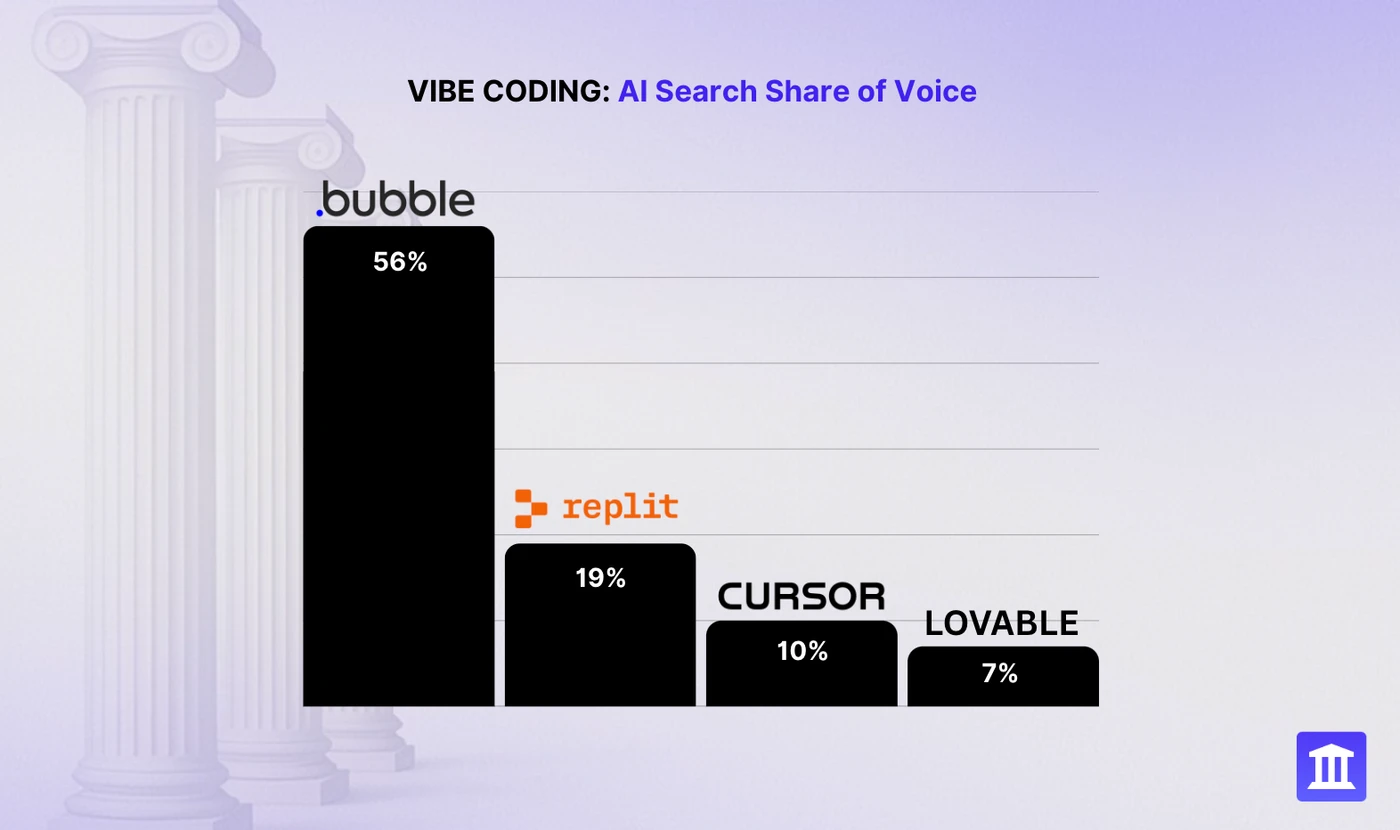

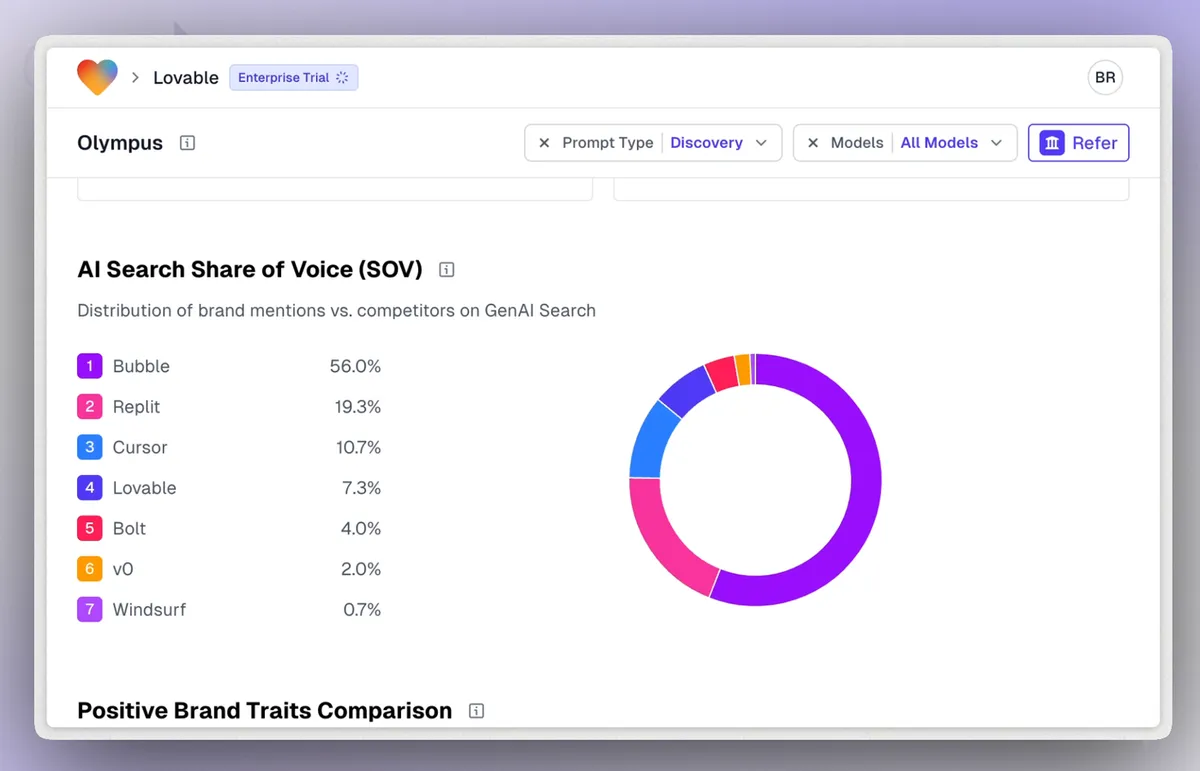

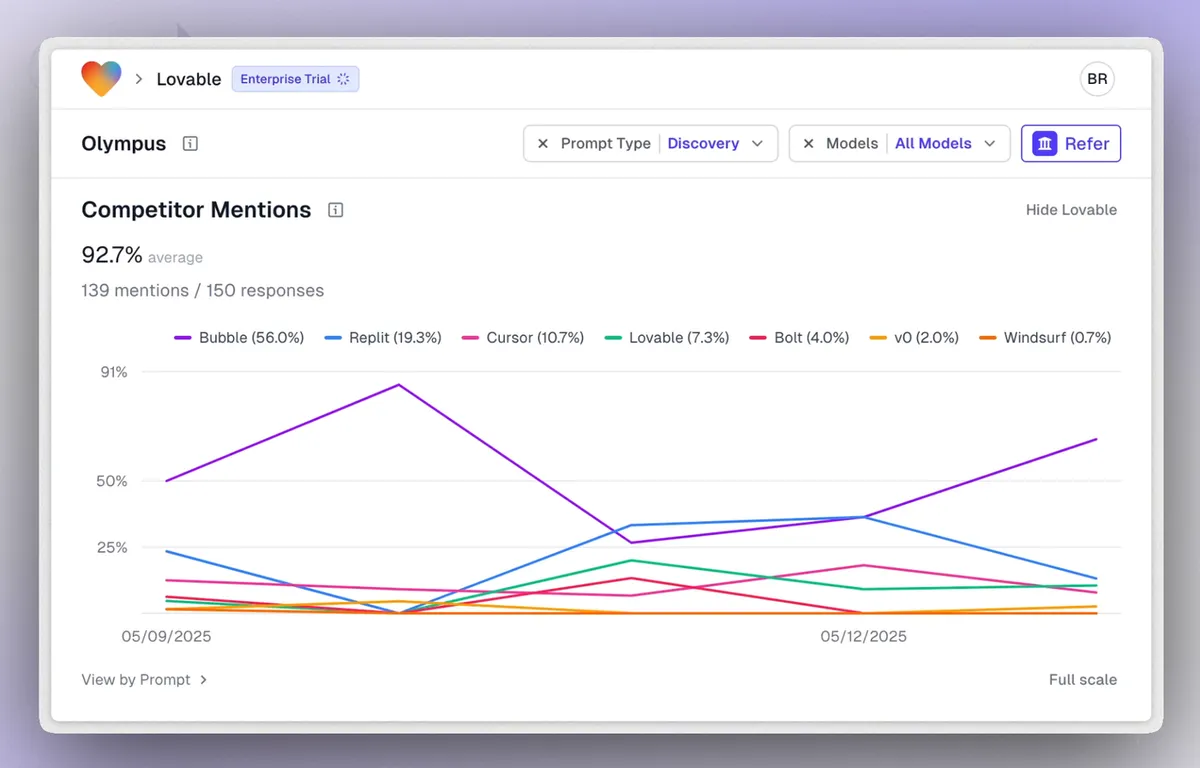

Market Share Reality: Established Players Lead the Pack

Despite Lovable's impressive traffic and growth metrics, our analysis at AthenaHQ shows that established players continue to dominate actual market share in the AI app development space. This discrepancy highlights an important distinction between viral growth and entrenched market position.

Bubble: The No-Code Market Leader

Bubble maintains its position as the market leader in the no-code/AI app building space through several key advantages:

- A mature ecosystem with years of established market presence

- An extensive plugin marketplace and integration capabilities

- A larger enterprise client base with deeper implementation

- More comprehensive documentation and community resources

While Lovable has shown remarkable growth in traffic and new user acquisition, Bubble's entrenched position with enterprise clients and its mature ecosystem give it a substantial lead in actual market share and revenue stability.

Replit: Developer-Focused Dominance

Replit holds the second position in market share through its strong appeal to the professional developer community:

- Broader language support and development capabilities

- A stronger position in educational markets and institutions

- More robust collaboration features for development teams

- An established presence in the GitHub and open-source communities

Replit's focus on serving professional developers with collaborative tools has secured its position, even as Lovable attracts attention with its AI-first approach.

Cursor: The AI-Enhanced IDE Leader

Cursor rounds out the top three, maintaining significant market share through:

- Deep integration with existing development workflows

- Advanced AI pair programming capabilities

- A strong appeal to enterprise development teams

- Seamless GitHub and version control integration

Cursor's approach of enhancing existing development practices rather than replacing them has secured its position among professional developers who require more sophisticated tools.

Understanding the Gap Between Traffic and Market Share

The discrepancy between Lovable's impressive traffic growth and the continued market share dominance of established platforms highlights several key factors in the AI development platform market.

Traffic vs. Revenue Reality

High traffic and user registration numbers don't always translate to market dominance. While Lovable has achieved $17 million ARR in a remarkably short time[1], established platforms like Bubble, Replit, and Cursor have:

- Larger enterprise client bases with higher average contract values

- More diverse revenue streams beyond subscription fees

- Established partnerships with major technology providers

- Higher customer retention rates and longer usage histories

The Adoption Curve Challenge

Lovable's rapid growth represents early adoption momentum, but market share leadership requires crossing the chasm to mainstream adoption. The established platforms benefit from:

- Proven track records with completed enterprise projects

- Established training and certification programs

- More case studies demonstrating ROI and success

- Stronger integration with existing enterprise systems

The Importance of AI-Optimized Market Analysis

Traditional traffic metrics can be misleading in the AI development platform space. At AthenaHQ, we've observed that comprehensive market analysis requires examining multiple dimensions beyond simple traffic numbers:

- Active project counts and completion rates

- Developer community engagement metrics

- Enterprise adoption and implementation depth

- Integration ecosystem breadth and utilization

What This Means for AI Development Platform Selection

For businesses evaluating AI development platforms, understanding the distinction between traffic growth and market share leadership is crucial for making informed decisions.

Matching Platform Selection to Business Needs

Different platforms excel in different scenarios:

- For rapid prototyping and MVPs: Lovable's AI-first approach may offer speed advantages

- For enterprise-grade applications: Established leaders like Bubble provide more proven stability

- For developer-focused organizations: Replit and Cursor offer stronger technical capabilities

- For non-technical founders: Consider the balance between accessibility and scalability

Looking Beyond the Hype Cycle

When evaluating platforms, organizations should consider:

- Actual implementation examples in their specific industry

- Platform stability and longevity prospects

- Total cost of ownership beyond initial subscription fees

- Learning curve and team adoption requirements

The Future Landscape: Convergence and Specialization

The AI development platform market is likely to evolve in two seemingly contradictory directions.

Increasing Convergence of Features

As the market matures, we're likely to see:

- Established platforms adopting more AI-first capabilities

- Newer platforms like Lovable expanding their enterprise features

- Greater standardization of core capabilities across platforms

- Improved interoperability between different development environments

Growing Specialization by Use Case

Simultaneously, platforms will increasingly differentiate by:

- Industry-specific templates and workflows

- Specialized AI capabilities for particular development needs

- Optimization for specific types of applications

- Integration with industry-specific tools and data sources

Protecting Your Brand in the AI App Development Ecosystem

As the AI app development market continues to evolve, companies need to ensure their brand maintains visibility and relevance across both traditional and AI-powered search channels. This is where Generative Engine Optimization (GEO) becomes critical.

How AthenaHQ Helps Companies Maintain Market Visibility

At AthenaHQ, we help companies protect their market position and increase share of voice through:

- AI Brand Mention Optimization: Our platform analyzes how your brand is currently represented in AI search results and implements strategies to increase relevant mentions.

- Technical Configuration Expertise: We help implement proper llms.txt configurations and other technical requirements that ensure AI platforms correctly understand and represent your company's offerings.

- Competitive Share of Voice Analysis: Our tools provide detailed analytics on how your brand performs against competitors like Lovable, Bubble, and others in AI-generated responses.

- Brand Mention OKRs: We help establish measurable objectives for AI visibility and provide the tools to track progress toward these goals.

Optimizing Your AI Development Strategy

For organizations navigating this evolving landscape, several strategies can help optimize development approaches.

Multi-Platform Expertise

Rather than committing exclusively to a single platform, consider:

- Using specialized platforms for appropriate use cases

- Building internal expertise across multiple platforms

- Creating standardized processes that work across platforms

- Evaluating new platforms as they emerge without full commitment

Focus on Business Outcomes Over Platform Hype

The most successful organizations:

- Define clear business objectives before selecting platforms

- Measure success by business impact rather than development metrics

- Maintain flexibility to adapt as the market evolves

- Prioritize user experience and business value over technical novelty

Conclusion: Beyond Traffic Metrics to Real Market Impact

While Lovable's impressive traffic growth and rapid revenue scaling demonstrate the excitement around AI-first development platforms, the market share reality confirms that established players like Bubble, Replit, and Cursor continue to lead in actual implementation and business impact.

For organizations seeking to optimize their AI development approach, looking beyond simple traffic metrics to understand the full market context is essential. By evaluating platforms based on their fit with specific business needs rather than general hype, companies can make more effective platform selections.

As the AI development platform market continues to evolve, we can expect both consolidation among major players and continued innovation from emerging platforms like Lovable. The winners will ultimately be determined not by traffic spikes or funding announcements, but by their ability to deliver real business value through simplified, powerful application development.

The low-code/no-code platform market is projected to grow from $32 billion in 2024 to $207.25 billion by 2032, with a CAGR of 26.1%[3]. Meanwhile, the software development AI market is expected to increase from $0.45 billion in 2024 to $1.34 billion by 2029[3]. These projections indicate substantial growth opportunities for all players in this space, regardless of their current market position.

Citations

[1] https://thegrowthmind.substack.com/p/how-lovable-grew-to-17m-arr-in-3