Salesforce vs. HubSpot: Who's Dominating CRM AI Search? (AthenaHQ Breakdown)

The Stakes of AI Brand Performance in CRM Software

The $65 billion CRM market is experiencing a fundamental shift as enterprise buyers increasingly turn to AI-powered search for software evaluation. Recent Forrester research shows that 94% of B2B software buyers now use generative AI tools during vendor selection, fundamentally changing how CRM platforms must compete for visibility and consideration.

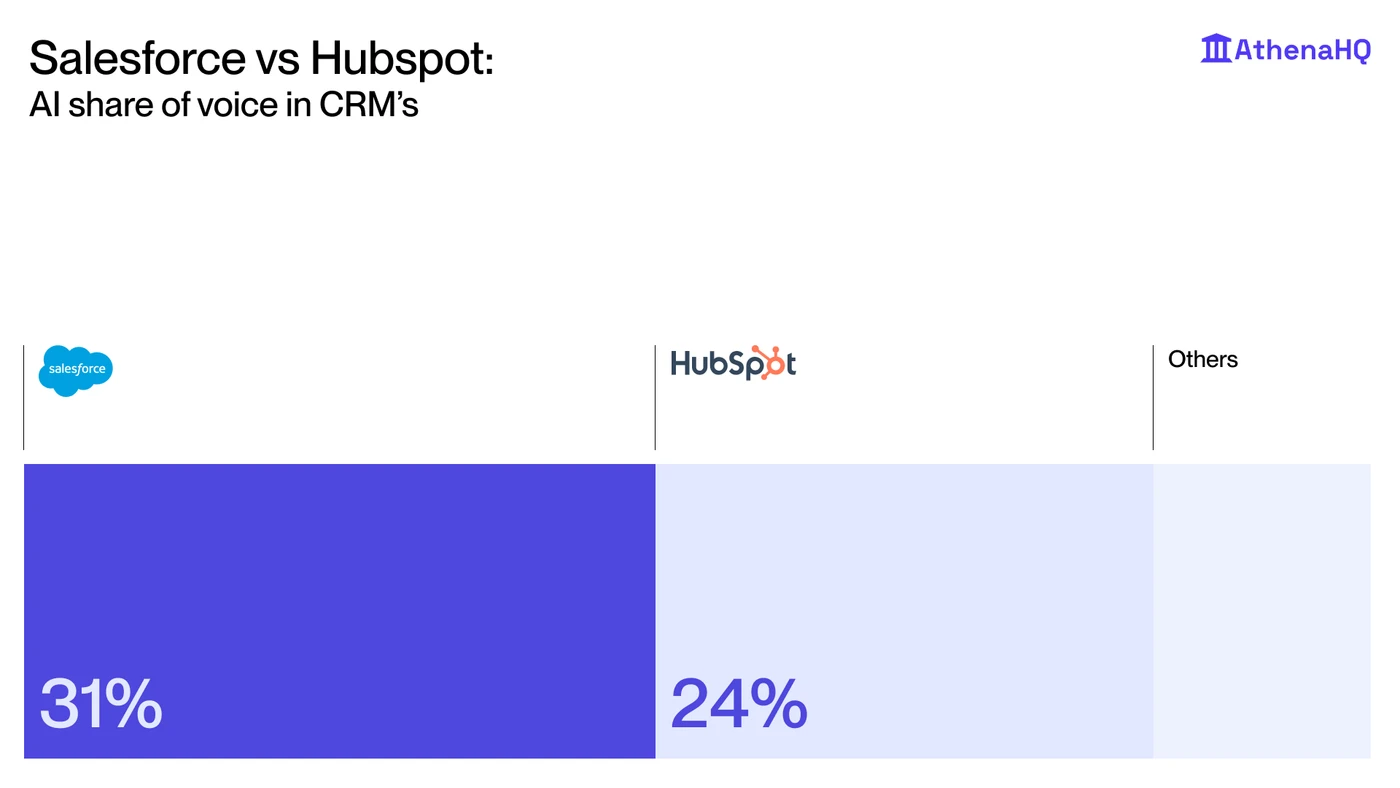

Recent AthenaHQ data reveals a surprisingly competitive landscape: among 233 responses analyzed across 2.1k sources, Salesforce leads with 31.4% share of voice in AI search results, followed by HubSpot at 24.2%—with Zoho delivering a stunning 21.0% performance that challenges traditional market assumptions.

Salesforce leads CRM AI search with 31.4%, but faces intense competition from HubSpot (24.2%) and surprising Zoho strength (21.0%) | Source: AthenaHQ analysis of 233 responses across 2.1k sources

This fragmented landscape contrasts sharply with more dominated software categories, creating both challenges and opportunities as AI platforms become the new front door for CRM discovery and evaluation.

The Salesforce–HubSpot Showdown: What the Data Reveals

Understanding the Platforms

- Salesforce has built its empire serving enterprise customers with comprehensive CRM, sales automation, and business platform capabilities. With extensive customization options and a vast ecosystem of integrations, it captures complex, high-value CRM discussions where feature depth and scalability matter most.

- HubSpot positions itself as the growth-focused alternative, combining CRM with marketing automation in an integrated, user-friendly platform. Its inbound marketing heritage and freemium model make it the go-to choice for SMBs and companies prioritizing ease of use and quick implementation.

The AI Search Reality Check

Despite traditional market share advantages, AthenaHQ's tracking data reveals a highly competitive AI search environment:

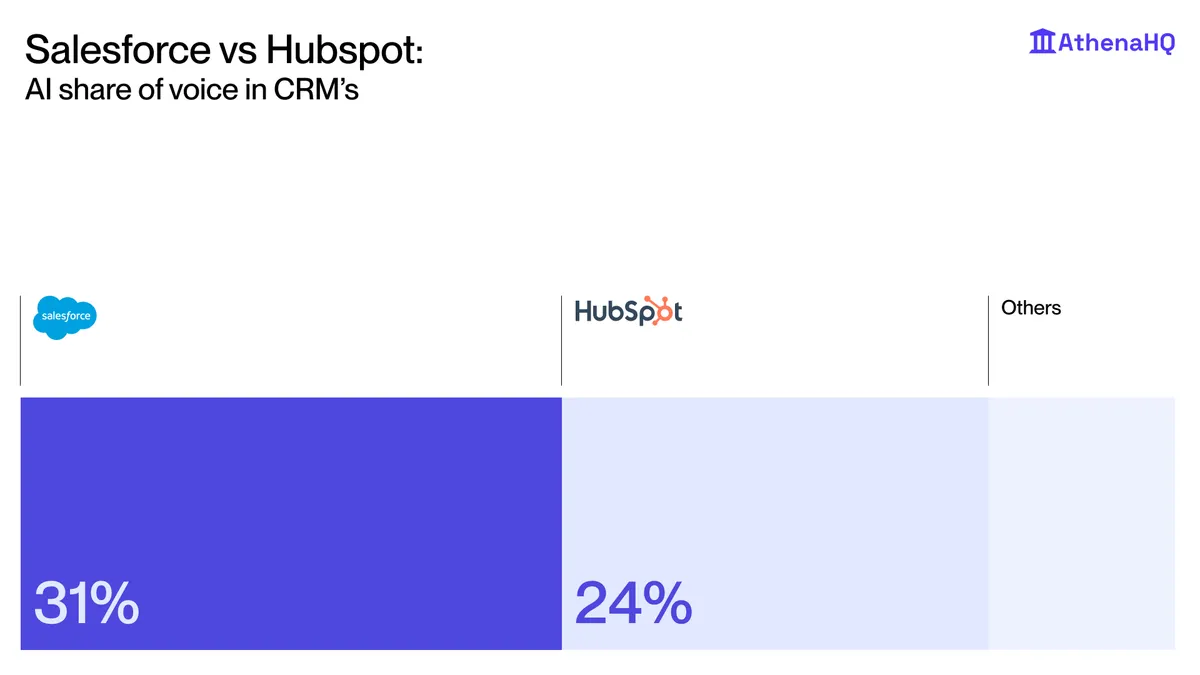

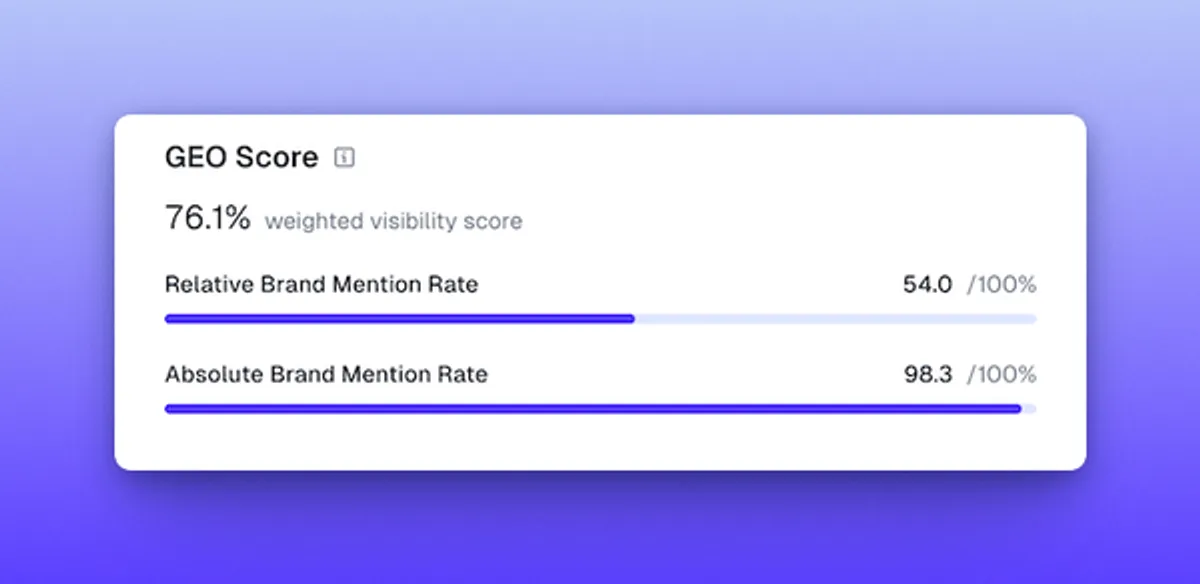

Advanced GEO analysis showing 76.1% visibility score and 0.8% citation rate across CRM discussions | Source: AthenaHQ Competitive Intelligence Dashboard

| Metric | Salesforce | HubSpot | Zoho | Other Competitors |

| AI Share of Voice | 31.4% | 24.2% | 21.0% | Microsoft Dynamics (8.2%), Others |

| Market Position | Enterprise Leader | SMB/Growth Focus | Value Leader | Various Specialists |

Critical insight: With just 0.8% citation rate across 233 responses, CRM recommendations are overwhelmingly opinion-based rather than factual, creating massive opportunities for brands that can build user advocacy and experience-driven content strategies.

Key Differences Shaping AI Performance

| Criteria | Salesforce | HubSpot | Zoho |

| Target Customer | Enterprise, complex sales orgs | SMB, growth companies | Small business, value-conscious |

| AI Positioning | Feature depth, enterprise credibility | Ease of use, integrated marketing | Comprehensive value, affordability |

| Mention Drivers | Integration discussions, enterprise features | User experience, quick implementation | Cost comparisons, small business success |

| Competitive Advantage | Ecosystem breadth, customization | Marketing automation integration | Suite comprehensiveness, pricing |

The Zoho Surprise: Achieving 21.0% AI share of voice despite being traditionally positioned as a budget alternative, Zoho's performance demonstrates how comprehensive functionality and value positioning can compete with brand recognition in AI-driven conversations.

Why AI Mentions Outweigh Traditional Marketing in CRM Selection

The Shift to Opinion-Based Recommendations

CRM buyers represent a unique category in AI search behavior. Unlike product research with factual comparisons, CRM selection involves complex organizational fit, user experience, and implementation considerations that make personal recommendations far more valuable than technical specifications.

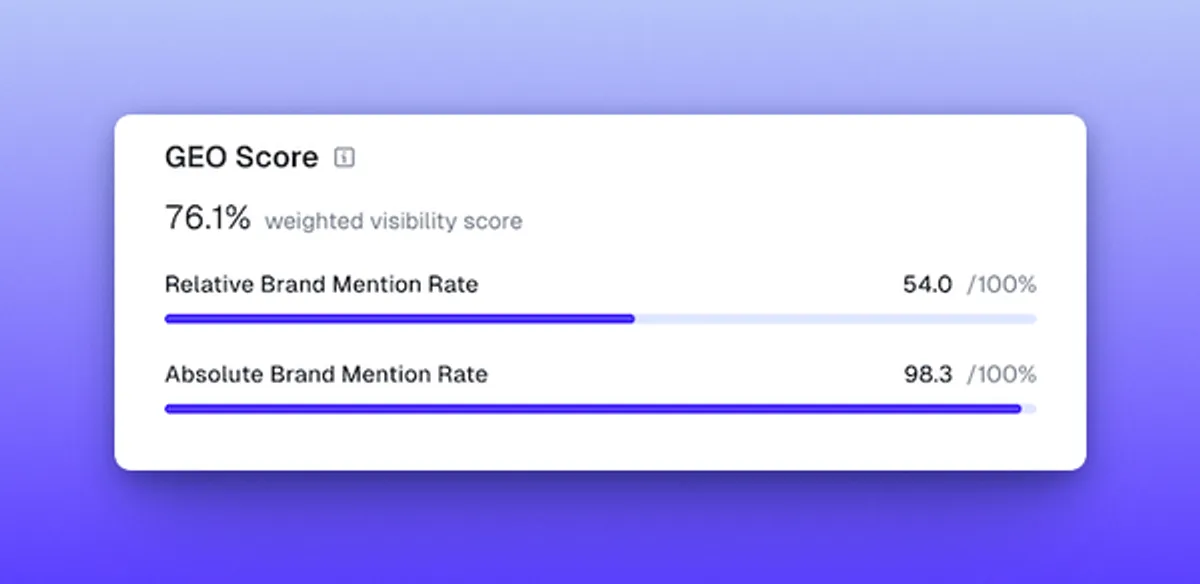

Timeline analysis showing 54.0% mention rate with model distribution led by ChatGPT (27.5%) and Perplexity (26.6%) | Source: AthenaHQ tracking across 424 relevant responses

Key Performance Indicators for CRM Brands:

- Implementation Success Stories: How often your platform appears in successful deployment discussions

- User Experience Authority: Frequency of mentions in ease-of-use and adoption conversations

- Feature Authority: Presence in specific capability and integration discussions

- Value Positioning: Visibility in ROI and cost-effectiveness conversations

The Revenue Impact of AI Visibility

According to industry analysis, CRM brands appearing in top AI responses see:

- 78% higher qualified lead rates compared to traditional search results

- 45% increase in demo requests from comprehensive project recommendations

- 62% boost in enterprise deal velocity from credible AI recommendations

Model Distribution Insights: ChatGPT leads CRM discussions at 27.5%, closely followed by Perplexity at 26.6%, with Gemini at 16.6% and AI Overview at 11.8%—indicating CRM buyers consult multiple AI sources during evaluation.

Salesforce's competitive position benefits from breadth: Their 31.4% AI share of voice translates to an estimated $1.8 billion additional pipeline opportunity compared to equal visibility scenarios. The 31.4% brand mentions versus 68.6% competitor mentions across 730 total analyzed mentions demonstrates the intense competition for CRM AI visibility.

AthenaHQ's Approach: GEO Excellence for Software Brands

What Sets AthenaHQ Apart for CRM Providers

AthenaHQ isn't just another marketing tool—it's the only platform purpose-built for generative engine optimization (GEO) in software markets. Founded by experts with backgrounds at Google Search and DeepMind, AthenaHQ enables CRM providers to:

Comprehensive analysis showing 76.1% GEO score and significant optimization potential in CRM AI search | Source: AthenaHQ Competitive Intelligence Dashboard

The data reveals critical insights: with a 76.1% weighted visibility score and just 0.8% citation rates, CRM brands have massive untapped potential in AI search optimization. Unlike traditional software marketing, CRM AI success requires opinion leadership rather than technical authority.

AthenaHQ Platform Capabilities:

- Monitor Use Case Mentions: Track how often your platform appears in industry-specific and size-specific CRM discussions

- Optimize User Experience Content: Ensure visibility in implementation, adoption, and success story conversations

- Measure Integration Authority: Quantify your platform's presence in ecosystem and workflow discussions

- Automate GEO Workflows: From customer story optimization to technical documentation structuring

The AthenaHQ GEO Framework for CRM Success

- Competitive Intelligence: Audit current visibility across use cases, company sizes, and implementation scenarios

- Content Strategy: Structure customer success stories, implementation guides, and feature comparisons for AI consumption

- Opinion Leadership: Build user advocacy through optimized case studies, testimonials, and experience content

- Performance Tracking: Monitor improvements in use case mentions, competitive positioning, and recommendation frequency

Technical Specification Example: Configuring for CRM AI Search

# llms.txt example for CRM optimization

User-agent: *

Allow: /customer-success/

Allow: /implementation-guides/

Allow: /feature-comparisons/

Disallow: /internal-pricing/

Brand: [Your CRM Platform]

Categories: CRM, Sales Automation, Customer Management

Expertise: Implementation, User Experience, Business ROI

Use Cases: Sales Management, Customer Service, Marketing Automation

Maximizing CRM AI Performance: Strategic Recommendations

How HubSpot Can Challenge Salesforce's Lead

1. Amplify User Experience Leadership

- Expand detailed onboarding and ease-of-use content for AI consumption

- Create comprehensive SMB implementation success stories

- Develop "getting started" content optimized for first-time CRM buyers

2. Leverage Marketing Integration Authority

- Position as the unified growth platform choice in AI conversations

- Create content around marketing-sales alignment ROI

- Develop integrated campaign success stories for AI platforms

3. Optimize for Growth Company Intent

- Structure content around scaling businesses and rapid implementation

- Create startup and growth company case study libraries

- Develop content addressing common growth-stage CRM challenges

Salesforce's Playbook: Defending Leadership

1. Enterprise Authority Expansion

- Leverage complex implementation success stories and enterprise case studies

- Create industry-specific solution content for AI consumption

- Develop technical integration guides and ecosystem content

2. Feature Depth Positioning

- Enhance customization and scalability content for AI platforms

- Create comprehensive capability comparison content

- Develop advanced use case documentation

3. Ecosystem Advantage

- Optimize AppExchange and integration marketplace content

- Create workflow and automation success stories

- Develop partner ecosystem case studies

Zoho's Opportunity: Capitalizing on Value Leadership

1. Comprehensive Suite Authority

- Position as the all-in-one business platform for AI conversations

- Create cross-application workflow and integration content

- Develop comprehensive business solution case studies

2. Value and ROI Leadership

- Optimize for cost comparison and ROI discussions in AI search

- Create small business success story libraries

- Develop total cost of ownership content for AI consumption

Performance Checklist for CRM Providers

- Set OKRs for implementation and user experience AI mentions

- Optimize customer success stories for conversational search

- Implement structured data for features, integrations, and use cases

- Configure llms.txt for AI crawler guidance specific to CRM use cases

- Track AI-driven lead quality and demo conversion rates

- Monitor competitor mention rates and positioning strength

- Develop industry and company-size specific content strategies

Real-World Impact: A mid-market CRM provider increased AI-driven qualified leads by 58% within five months of implementing AthenaHQ's GEO recommendations, with particular strength in user experience and implementation conversations.

The Future of CRM Discovery and Selection

Beyond Traditional Market Leadership

While Salesforce maintains traditional market dominance, the AI search landscape reveals different competitive dynamics. Zoho's remarkable 21.0% AI share of voice demonstrates that comprehensive value propositions can compete with pure market leadership in conversational recommendations.

The implications are transformative:

- User experience increasingly trumps feature breadth in AI recommendations

- Implementation success stories drive algorithm preference over traditional marketing

- Value positioning creates defensible advantages in cost-conscious conversations

- Specialized expertise can compete with generalized market leadership

What This Means for CRM Buyers

The fragmented AI search landscape provides more balanced vendor evaluation than traditional marketing channels. Buyers benefit from:

- Multiple viable options receiving meaningful AI visibility and consideration

- Use case-specific recommendations that favor specialized solutions over generic market leaders

- Experience-driven insights that prioritize user satisfaction over vendor marketing spend

What This Means for CRM Vendors

Opportunity for Focused Players: The opinion-driven nature of CRM AI search creates opportunities for specialized providers to capture specific conversations and challenge traditional market hierarchy through superior user advocacy.

Content Strategy Imperative: With 0.8% citation rates proving that experience trumps authority, comprehensive user success content, implementation guides, and customer advocacy become critical competitive assets.

Conclusion: The CRM AI Search Revolution

As Salesforce maintains its 31.4% AI share of voice lead over HubSpot's 24.2%—while facing Zoho's surprising 21.0% challenge—the message is clear: traditional CRM market advantages matter less than user advocacy and AI search optimization. The fragmented landscape, with 8 viable competitors and opinion-driven recommendations, creates unprecedented opportunity for focused CRM providers to capture mind share through superior content strategy.

The AthenaHQ data reveals both urgency and opportunity: With a 76.1% GEO score indicating massive optimization potential and just 0.8% citation rates showing opinion-based recommendations, CRM vendors can no longer rely on traditional sales and marketing advantages. Success requires understanding that AI search rewards user satisfaction, implementation success, and strategic content optimization over pure market dominance.

For CRM providers ready to compete in the AI search era: The conversation about your platform is happening across ChatGPT, Perplexity, Gemini, and other AI platforms with or without your optimized participation. AthenaHQ provides the competitive intelligence, content strategy, and performance tracking to ensure your CRM solution captures its share of the evaluation conversations that drive enterprise software decisions.

The future of CRM selection is being written in AI search results. Make sure your platform is part of the story.

Citations

[1] The State Of Business Buying, 2024 - Forrester

[2] Best CRM Software: User Reviews from October 2025 - G2